March 02, 2023

Evonik delivers: Robust earnings in difficult environment

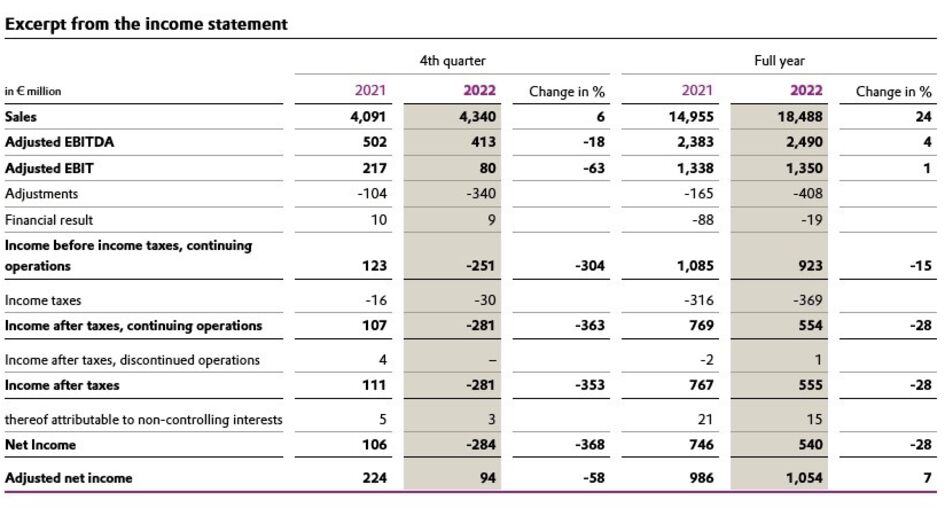

- Adjusted EBITDA up 4 percent to €2.49 billion

- Guidance for 2023: Adjusted EBITDA between €2.1 and €2.4 billion

- From 2030 onward, all purchased electricity will stem from renewable sources

Essen, Germany. After a challenging year 2022, Evonik is cautiously optimistic for 2023. "The effects of war, high inflation and heavily fluctuating energy prices demanded a lot from us-and they still do," says Christian Kullmann, Chairman of the Executive Board. "Nevertheless, we were able to achieve the best operating result in the past ten years. Evonik is well-positioned for difficult times. This will also pay off in the current year."

The past year was characterized by a very successful first six months, followed by a much more difficult second half. Overall, sales increased by 24 percent to €18.5 billion. Volumes declined slightly, and prices for raw materials and energy rose sharply in some cases. Evonik was able to pass on most of the prices increases. Adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) rose by 4 percent, narrowly meeting the lower end of the forecast range of €2.5 billion to €2.6 billion. At €2.49 billion, earnings were the highest since 2012.

Net income declined, mainly due to an impairment of goodwill in the Performance Materials Division amounting to €301 million. Adjusted net income increased by 7 percent to €1.05 billion.

Free cash flow reached €785 million. This corresponds to a cash conversion rate of 32 percent, slightly above the target that Evonik had adjusted to 30 percent during the year. "The two very different business environments in the first and second half of 2022 made it difficult for us to manage inventories," says Chief Financial Officer Ute Wolf. "At the end of the year, we lasered in on these issues. This fully paid off with a very strong free cash flow in the final quarter."

The Executive Board and Supervisory Board will propose to the Annual General Meeting on May 31 an unchanged annual dividend of €1.17 per share. This represents an attractive dividend yield of around 5 percent.

Despite numerous uncertainties, Evonik is cautiously optimistic for 2023. Much will depend on how sustainably energy prices and inflation will soften, and how strong the recovery of the global economy is going to be, especially with respect to China. In the first quarter of 2023 in particular, the negative trend of the second half of 2022 will likely continue. From the second quarter onward, the situation should gradually improve.

For 2023, Evonik expects sales in a range from €17 billion to €19 billion. Adjusted EBITDA should amount to between €2.1 billion and €2.4 billion. Compared with the previous year, the expected resilience of the Specialty Additives and Smart Materials divisions and the Health & Care business will be offset by an earnings decline in the Animal Nutrition and Performance Intermediates businesses, which are mainly price-driven. Free cash flow is expected to increase, and the cash conversion rate should improve toward the target of around 40 percent. "Our guidance range is wider than last year in view of the ongoing uncertainties. We have set ambitious targets and intend to achieve them with joint efforts," says Kullmann. Expected cost savings of €250 million will contribute to the anticipated results.

PORTFOLIO, SUSTAINABILITY, INNOVATION

Despite the difficult environment, Evonik is pressing on with its transformation toward sustainability and profitability. "We are systematically focusing our investments on sustainable growth markets and we are divesting cyclical businesses," says Kullmann. "In this context, the sale of our Luelsdorf site will be the first step in the planned divestiture of the businesses in our Performance Materials Division." Negotiations for the Luelsdorf sale are at an advanced stage.

In parallel with the planned divestments, Evonik is making targeted investments in six defined innovation growth fields that promise high returns. This is already paying off: Sales from these innovation growth fields rose more than 20 percent last year to €600 million. "These products have a high growth potential and above-average margins," says Chief Innovation Officer Harald Schwager. "Our goal is clear: We want to generate €1 billion in sales with these innovative products by 2025 - and we are right on track."

The new products strengthen Evonik's sustainability profile. The share of Next Generation Solutions, i.e. products that offer customers a higher sustainability benefit compared with common alternatives, rose to 43 percent of revenue last year. "Evonik has set itself the goal of investing more than €3 billion in the growth of Next Generation Solutions by 2030 in order to increase their share to more than 50 percent," says Thomas Wessel, who is responsible for sustainability on the Executive Board.

Another important step in the sustainable transformation is the rapid overhaul of the energy supply. Due to power purchase agreements for wind energy, more than half of the electricity Evonik buys externally will come from renewable sources from 2026. By 2030, Evonik will exclusively purchase green electricity.

Partly to manage geopolitical risk, Evonik spreads investments in new product development across its three core regions. For example, the company has opened a new research center for lithium-ion batteries in Shanghai. In Japan, the company is expanding production capacity for alumina for the battery market. A production plant for biodegradable surfactants is being built in Slovakia. In the USA, groundbreaking is imminent for a plant for pharmaceutical lipids required for mRNA-based medicines.

DEVELOPMENT OF THE CHEMICALS DIVISIONS

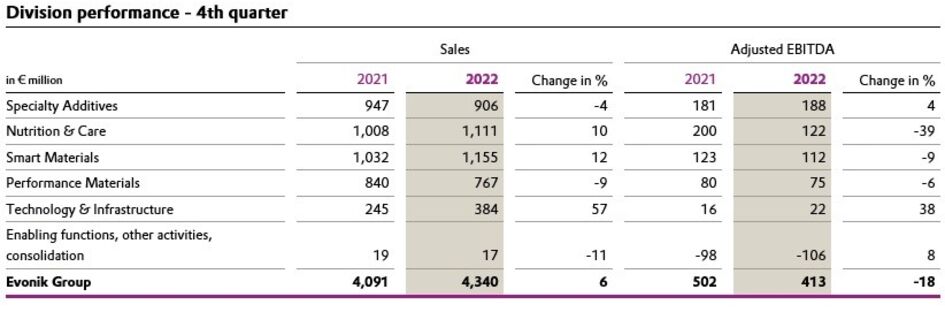

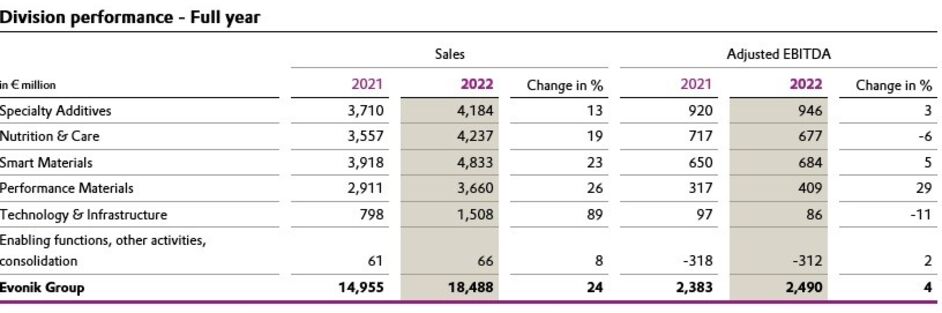

Specialty Additives: Overall, the division recorded a successful business development. Its sales rose 13 percent to €4.18 billion as a result of significantly higher selling prices, mainly from passing on higher raw material costs, and positive currency effects. Additives for polyurethane foams for durable consumer goods and for the automotive industry generated higher sales at improved prices. Products for the construction and coatings industries and for renewable energies also developed positively. Adjusted EBITDA rose by 3 percent to €946 million.

Nutrition & Care: Sales in the Nutrition & Care Division rose 19 percent to €4.24 billion. The increase resulted from significantly higher selling prices to offset higher costs, as well as positive currency effects. Sales volumes were down. Evonik achieved significant sales growth with essential amino acids thanks to improved selling prices. Volumes declined mainly due to volatile demand in Asia, with corona lockdowns in China weighing on business. In the animal feed industry, worldwide destocking to reduce inventories led to declining selling prices, despite the continued high raw material costs. Sales of health and beauty care products increased significantly thanks to strong demand for active ingredients for cosmetic applications. Adjusted EBITDA fell by 6 percent to €677 million.

Smart Materials: Sales in the Smart Materials Division climbed 23 percent to €4.83 billion. The increase resulted from significantly higher selling prices from the passing on of higher raw material costs, as well as positive currency effects. Volumes sold were stable. Sales of both inorganic products and polymers increased thanks to higher selling prices, with volumes remaining virtually unchanged. Adjusted EBITDA rose by 5 percent to €684 million.

Performance Materials: Sales of the Performance Materials Division improved by 26 percent to €3.66 billion. Significantly higher prices and positive currency effects contributed to the increase, while volumes declined noticeably. Business with products from the C4 Verbund saw declining volumes, while revenue increased because of improved selling prices. The alcoholates business benefited from necessary price increases. Sales of superabsorbents also increased, additionally benefiting from improved market conditions. Adjusted EBITDA rose by 29 percent to €409 million.

FURTHER INFORMATION

Evonik: Leading beyond chemistry

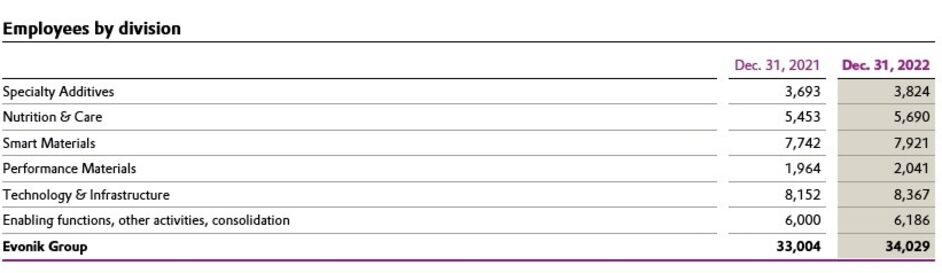

Evonik goes beyond the boundaries of chemistry with its combination of innovative strength and leading technological expertise. The global chemical company, headquartered in Essen, Germany, is active in more than 100 countries and generated sales of €15.2 billion and earnings (adjusted EBITDA) of €2.1 billion in 2024. The common motivation of the approximately 32,000 employees: to provide customers with a decisive competitive advantage with tailor-made products and solutions as a superforce for industry, thereby improving people's lives. In all markets. Every day.

Disclaimer

In so far as forecasts or expectations are expressed in this release or where our statements concern the future, these forecasts, expectations or statements may involve known or unknown risks and uncertainties. Actual results or developments may vary, depending on changes in the operating environment. Neither Evonik Industries AG nor its group companies assume an obligation to update the forecasts, expectations or statements contained in this release.

Evonik Industries AG

Rellinghauser Straße 1-11

45128 Essen

Germany

Phone +49 201 177-01

www.evonik.com

Supervisory Board Bernd Tönjes, Chairman Executive Board Christian Kullmann, Lauren Kjeldsen, Dr. Claudine Mollenkopf, Thomas Wessel

Registered Office is Essen Register Court Essen Local Court Commercial Registry B 19474

Online version press release